Leaving Fossil Fuels in the Ground: Who, What and When?

In order to promote a broader conversation on the issue of equity and stranded assets (i.e. the need to leave fossil fuels in the ground in order to avoid dangerous climate change), Oxfam recently released a report discussing whether there is a reasonable case to be made that developing countries should get preferential treatment so that they bear less of the burden when it comes to having their assets stranded. To support the launch of that report, Oxfam also produced a blog, which compared estimates of the remaining carbon budget with proven fossil fuel reserves[1] in developing countries. The remarkable finding of that work was that if developed countries bore the full burden of stranding their own assets, the known fossil fuel reserves in developing countries (not including China) could be exploited, and the world would still stand a 50% chance of keeping global temperature rise below 1.5oC. The opportunity to exploit these assets was estimated to be worth tens of trillions of dollars.

In this blog we build on these findings by updating the analysis with the latest available data, assessing how much last year’s emissions have dented the global carbon budget, distinguishing the carbon content of reserves by fuel type, and estimating how long it will take for the budget to be exhausted at current trends.

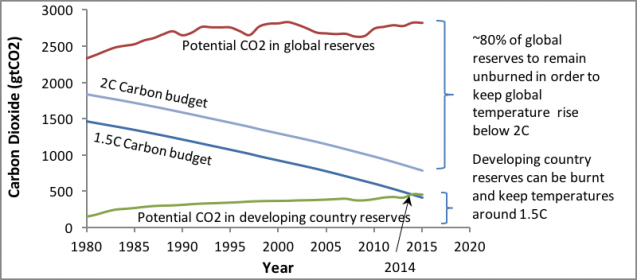

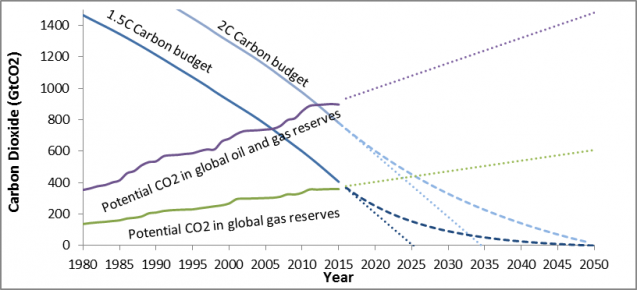

The figure below compares the global carbon budgets[2], for 1.5oC and 2oC, with the potential emissions stored in proven fossil fuel reserves.

What is immediately clear from this graph is that there is far more carbon in the world’s global reserves than could possibly be burned safely. This figure is even more concerning as it ignores the likely CO2 contribution from non-fossil sources such as land-use change and concrete. A second point, however, is that the reserves in developing countries are slightly bigger than the 1.5oC budget. While in 2014 the 1.5oC budget and the potential CO2 in developing country reserves were equal (indicating that you could burn all the reserves in developing countries and still keep global temperature rise below 1.5oC, as per the previous blog), the estimated 39.9 gigatons of CO2[3] that we emitted in 2015 means burning all the reserves in developing countries would now likely increase global average temperatures by more than 1.5oC.

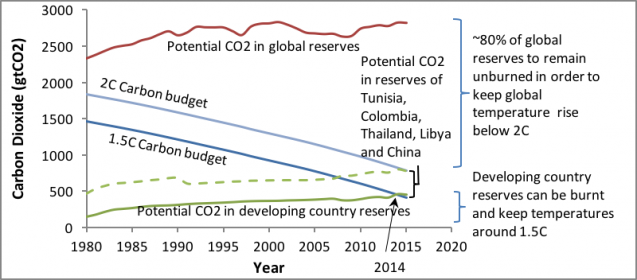

If we consider increasing the carbon budget to 2oC, however, we find that we can add Tunisia, Colombia, Thailand, Libya and China to the list of developing countries that could safely burn their existing reserves and the world would still stand an 80% chance of keeping global temperature rise below 2oC – see the dotted green line added to the graph below.[4]

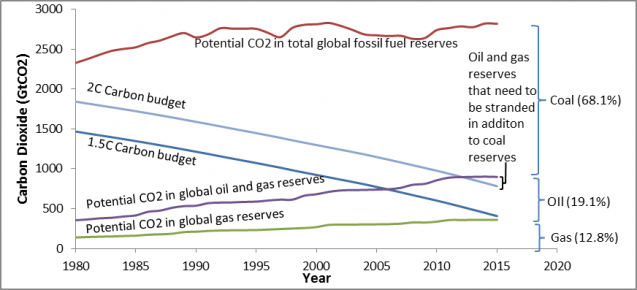

In addition to looking at the geographical redistribution of where proven fossil fuel reserves are located, it is also interesting to distinguish the fossil fuel reserves based on their potential CO2 emissions to assess if we can be smarter about the way we strand fossil fuels. The below figure stacks the gas, oil and the coal reserves and compares them with the two carbon budgets. What is immediately clear is just how big of a proportion of potential emissions are contained in global coal reserves.

Also noticeable is that, together, the world’s total oil and gas reserves are only a little bit larger than the 2oC global carbon budget. This suggests that, provided all world’s coal reserves remain in the ground, almost all the countries in the world could exploit their existing oil and gas reserves and the world would still stand an 80% chance of keeping global temperature rise below 2oC (though this ignores non-fossil fuel emissions). Looking at the actual country data under this scenario, it turns out that the only countries that also need to strand all of their fossil fuels are those with an HDI above 0.85. There are only 12 countries with proven reserves of hydrocarbons that fall into this category: Qatar, Brunei, Italy, Israel, the UK, Canada, the US, Germany, the Netherlands, Denmark, Australia and Norway.

Considering the above, there are good reasons to focus on stranding coal (or at least thermal coal, which is used in electric power stations) before oil and gas. First, coal is a particularly high-carbon form of energy. Burning it gives off a lot of carbon dioxide for relatively little energy. Second, coal is not particularly valuable as an export (certainly not when compared to oil and gas) and as such the opportunity cost of stranding it (in terms of foregone revenue) is not so large. Third, while coal does have significant value as a cheap source of energy, coal is poorly suited to integrating with renewable energy sources. This is because coal fired power stations take a long time to start up (8 – 24hrs). This means that coal power cannot respond quickly enough to account for the sudden drop off that can occur with renewable energy sources.

A focus on equity helps to reframe the way we think about stranded assets, allowing us to focus on what to strand and highlighting the importance of questions about who should bear the burden when it comes to stranding. This is not to say that developed countries should literally strand their assets immediately and developing countries should be allowed to continue to exploit theirs. Such a suggestion would not be practically feasible, nor would it be economically desirable given the costs involved in such approach. Indeed, a post-extraction redistribution system whereby low-cost projects continue to operate and high-cost producing countries are compensated to strand their assets is economically more efficient.

That said, taking an equity approach does nothing to ease the challenge of reducing CO2 emissions fast enough to maintain a safe level of temperature rise. To make this clear, consider one final graph[5].

Above we have plotted the rate at which the different carbon budgets will be eliminated. If we assume that emissions remain constant, the 1.5oC budget runs out sometime in 2025[6], while the 2oC budget runs out sometime in 2035. At the same time, if trends in fossil fuel exploration continue, we can expect fossil fuel reserves to continue to grow. Such an outcome not only raises significant financial risks around stranded assets, it also highlights the extent to which the major challenge in the fossil fuel sector has changed from a focus on peak oil, to a focus on too much oil.

Reducing our emissions is no simple task. This can be seen in the shallow curves that bend off the respective carbon budgets and that represent the rates of decrease that will be required to ensure we do not blow the carbon budget before 2050. For a 1.5oC increase, we will need to decrease emissions at a rate of around eight and a half percent annually. For 2oC, the rate is around three and a half percent. While these numbers might not seem large, an eight and a half percent decrease in current emissions is the equivalent of pulling about 980 coal fired power stations off-line in one year!

The story above makes clear the need to simultaneously: 1) halt future prospecting for fossil fuel reserves to avoid future stranded assets; 2) scale up our investment in renewable energy technologies so that we can get off coal powered electricity as soon as possible; 3) seriously consider the equity dimensions of stranded assets. None of these processes will be simple, and nuanced approaches will be necessary in order to promote efficiency. However, as a set of broad directives, these three goals need to lie at the heart of all future natural resource management decisions.

We hope this piece contributes to the equity dimension in the stranded assets discussion and look forward to continuing the discussion at the 11th Annual Columbia International Investment Conference entitled “Climate Change and Sustainable Investment in Natural Resources: From Consensus to Action”,

The authors would like to thank Khyati Thakker for her help in putting the data together and Perrine Toledano for her helpful comments.

[1] ‘Proven reserves’ of fossil fuels refer to fossil fuels that are in the ground and that are known (with a 90% certainty) to be recoverable under current technical and market conditions.

[2] These are calculated at a 50% confidence for 1.5oC and 80% confidence for 2oC. The reason for the difference is that we have already gone beyond standing an 80% chance of remaining within 1.5oC. We use the most risk averse percentages still available to us as published by Carbon Tracker.

[3] Which is approximately equal to the potential CO2 stored in all of the proven reserves of the United Arab Emirates

[4] Note that we have just ranked countries based on the Human Development Index (HDI) – where countries with the highest HDI get the least preference when it comes to benefitting from global fossil fuel reserves. In our research report, the author suggests a more complicated process for stranding based on some mix of HDI, historic benefit from fossil fuels and alternative development options. For a future blog we may well consider what a reorganization of these countries would look like if we were to generate a more complex index for ranking countries.

[5] Note we have changed the scale of the y-axis to zoom in on the bottom right of the above graphs. This means that the world total emissions go off the top of the graph

[6] Note elsewhere this budget has been forecast as running out in just 5 years. The reason for this difference is that they are using a 66% confidence level for staying within 1.5oC, and likely using a less optimistic view on stabilizing emissions.